Homeowners Insurance in and around Hillsboro

Looking for homeowners insurance in Hillsboro?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- PORTLAND

- BEAVERTON

- HILLSBORO

- TIGARD

- LAKE OSWEGO

- SALEM

- EUGENE

- BEND

- SEATTLE

- SPOKANE

- BOISE

- SAN DIEGO

- LOS ANGELES

- SACRAMENTO

- TACOMA

Home Sweet Home Starts With State Farm

Being at home is great, but being at home with coverage from State Farm is even better. This terrific coverage is more than just precautionary in case of damage from blizzard or windstorm. It also can cover you in certain legal cases, such as someone getting injured in your home and holding you responsible. If you have the right coverage, your insurance may cover these costs.

Looking for homeowners insurance in Hillsboro?

Apply for homeowners insurance with State Farm

Don't Sweat The Small Stuff, We've Got You Covered.

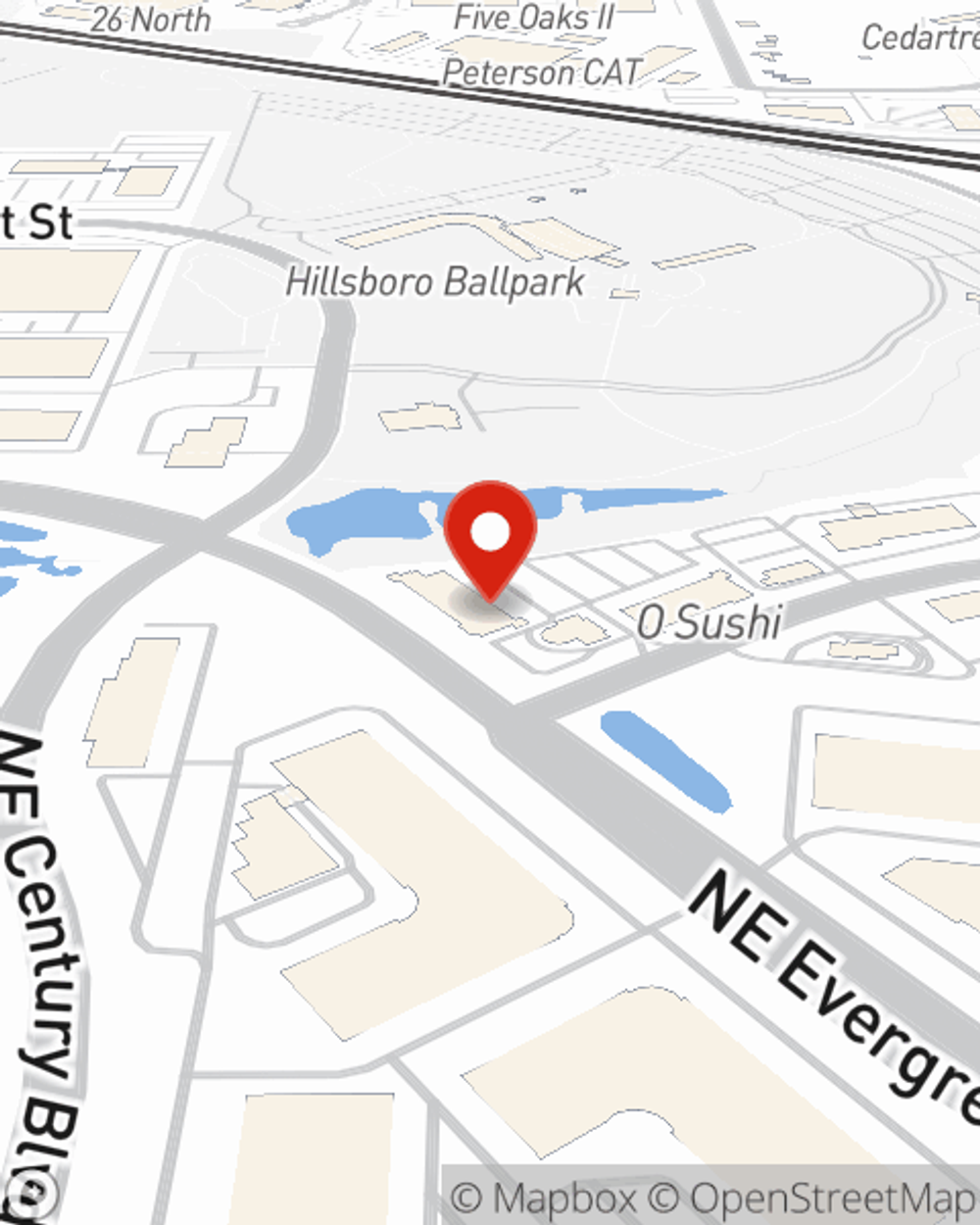

With this outstanding coverage, no wonder more homeowners embrace State Farm as their home insurance company over any other insurer. Agent Grant Murphy would love to help you choose the right level of coverage, just reach out to them to get started.

There's nothing better than a clean house and coverage with State Farm that is value-driven and dependable. Make sure your belongings are covered by contacting Grant Murphy today!

Have More Questions About Homeowners Insurance?

Call Grant at (503) 681-2118 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Grant Murphy

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.